During any current tax season or calendar year a timely tax return would be prepared and e-filed for the previous calendar year. Our clients find that stronger management of tax data helps them meet data retention requirements and make decisions that drive their.

Gst Stock Photo And Image Collection By Ismail Sadiron Pictures Shutterstock

PROMO Be at ease.

. The province of Quebec collects the Quebec Sales Tax QST which is based on the GST with certain differences. Taxable and non-taxable sales. Guideline for Verification of Application for grant of new GST registration.

GST is a dual taxation model where both the Indian states and the Indian central government apply tax on services and goods. CCH Integrator is a powerful data management tool for tax information capable of capturing structured and unstructured data alike feeding this data into your tax calculations and leveraging your tax data for current and future applications. Inland Revenue allows taxpayers to use a tax pool to satisfy tax payable Income Tax GST FBT RWT PAYE from audits and voluntary disclosures within certain criteria.

He wants to file his income tax return for the assessment year 2015-16 and 2016-17. Determine his residential status for the said two years. The Authority for Advance Ruling under GST Maharashtra in the case of Basf India Limited- 2018-TIOL-82-AAR-GST dated 21st May 2018 has held that goods sold on HSS by the HSS seller is a supply which is not taxable under GST ie non-taxable supply and is an exempt supply.

An excise duty is an indirect tax imposed upon goods during the process of their manufacture production or distribution and is. Latest GST Ready Reckoner 2022 by CA Raman Singla Customs Exchange rate for Import. Most businesses can claim back the GST HST and QST they pay and so effectively it is the final consumer who pays the tax.

Based on customer data for invoices paid online versus offline from Jan 2016- Dec 2016. GST consists of 3 types of taxes. Income tax returns are due.

Rajya Sabha then passed 4 supplementary GST Bills and the new tax regime implemented on 1st July 2017. IRDAI extends Guidelines on Information. During January 1 2022 - April 18 2022 you prepare and e-file taxes for the tax year of.

GST went live in 2016 and the amended model GST law passed in both the house. The PayPal service is provided by PayPal Australia Pty Limited ABN 93 111 195 389 which holds Australian Financial Services Licence number 304962. The tax is collected by the Income Tax Department for the central government.

PayPal is an optional fee-based service. In the Finance Act 2020 the Government introduced a new tax regime for individuals giving them the option to opt for the new regime or continue with the old regime. If you supply or receive an invoice that only has a figure at a wine equalisation tax-goods services tax WEG label you need further information to claim GST credits and for it to be considered a valid tax invoice.

Farmers - who constitute 70 of the Indian workforce - are generally excluded from paying income tax in India. Determine his residential status for the said two years. In 2017 the passing of 4 supplementary GST Bills in Lok Sabha as well as the approval of the same by the Cabinet.

Get paid faster. The implementation of the Goods and Services Tax GST in India was a historical move as it marked a significant indirect tax reform. Central tax state tax and integrated tax.

Input Tax Credit of common inputs capital goods and input services to the extent. Through the pool a taxpayer can purchase historical tax payments of unpaid tax from prior tax periods saving more than 30 over the cost of use-of-money interest incurred if settled directly with IRD. Pirelli the sole supplier of Formula One tyres said its adjusted earnings before interest and tax EBIT came at 253 million euros 258 million in the April-June period topping a company.

A tax season prepare and e-file returns for the previous calendar or tax year is from January 1 until October 15 of any current year. The President of India also gave assent. The history of the Goods and Services Tax in India dates back to the year 2000 and culminates in 2017 with four bills relating to it becoming an ActThe GST Act aims to streamline taxes for goods and services across India.

Googles location that provides. GSTR 20131 Goods and services tax. NOTICE PAKISTAN Operate by Enagic Malaysia Sdn Bhd.

Any information provided is general only. If youre located in India youll be charged a Goods and Services tax GST on all the purchases you make. To put it simply.

Mock Test Papers Series I for November 2022 CA Examination. Tax invoices sets out the information requirements for a tax invoice in more detail. New promotional products have returned with the PWP.

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

Gst To Subsume Sales Tax Vat Service Tax And Much More Details Here

Pdf Goods And Services Tax Gst In Malaysia Behind Successful Experiences

Five Key Trends Managing Vat Gst Evolution Across Asia Pacific International Tax Review

What Is Gst In India Tax Rates Key Terms And Concepts Explained India Briefing News

Checkout The Gst Rate Chart 2017 Now Here At Taxguru Find Out The The Changes Made By Gst In India Chart Rate Goods And Service Tax

Complete Sst System Setup Guideline Help

Complete Sst System Setup Guideline Help

Yyc Advisors Recommended Gst Tax Code Listings For Supply Source Accounting Software Enhancement Towards Gst Compliance Revised As At 18 July 2016 By Customs Facebook

What Is Gst In India Tax Rates Key Terms And Concepts Explained India Briefing News

Will Gst Have Any Affect On The Car Prices Quora

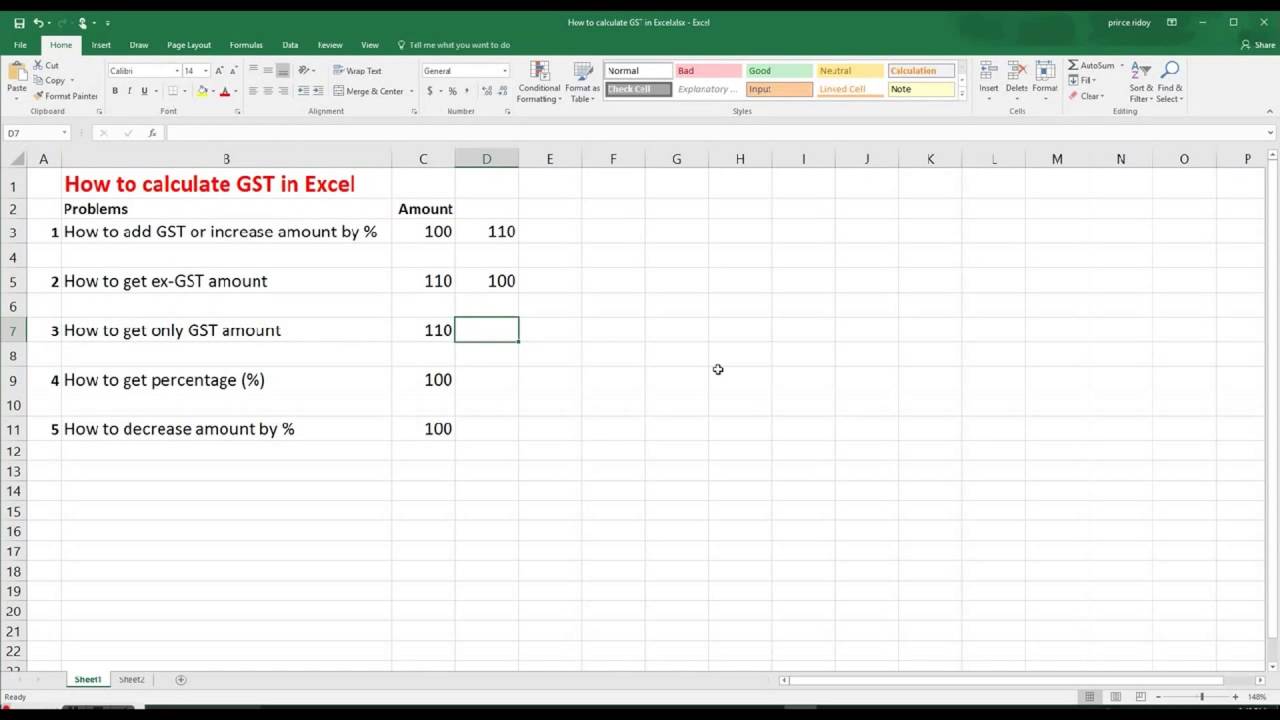

How To Calculate Gst In Excel By Using Different Techniques With Easy Step By Step Tutorial Youtube

Excel Tutorial Formulas For Calculating Gst At 15 Youtube

Finally Gst Goods And Services Tax Bill Has Been Passed In Rajya Sabha India We Would Be Hel Creative Advertising Goods And Service Tax Creative Branding